- How much is the rent?

- What date is the property available from?

- What furniture (if any) and white goods are supplied?

- Is the landlord planning to make any changes to the property or will it be let exactly as viewed?

- Is there any parking allocated? Is there an extra charge for parking?

- Are there any restrictions on the type of tenant?

- How much is the deposit if required or deposit alternative?

Be clear with the agent on the terms proposed. For example, you may have offered to pay the full asking rent, providing that the landlord will agree to your tenancy starting on the 1st June for 12 months and will supply a washing machine. The agent will need to check the terms proposed with the landlord and get their agreement.

-

- APPLICATION FORM – Please fill out ALL sections of the application form, if it doesn’t apply to you, put N/A – This will be sent via DocuSign

- RESERVATION (HOLDING FEE) – Bank details are on the application form, this payment is then applied to your rental upon move in

- REFERENCE CHEKCS VIA VOUCH – We use a 3rd party company to carry out all the reference checks, you will receive an email on how to upload all your documents

- CREDIT HISTORY – This will tell us if you have any Bad Credit History, CCJ’s or Bankruptcy. If you do, we will need a Guarantor to act on the Tenancy

- PROOF OF ID – Copy of your Passport or Driving Licence

- PROOF OF INCOME – 2 months wages slips are required. If the rent is more than 40% of your annual income, we will need a Guarantor

- PREVIOUS LANDLORD – We will collect a verbal reference, so we will need your previous landlords name and number

- GUARANTOR – We will require a Guarantor if you are a student, or you are not in permanent Full Time employment. If a Guarantor is required, we will need the Guarantor to fill out an application form and provide wage slips or mortgage statement, so please ask them first.

You may be asked by the agent to get in touch with your employer if they are slow in providing a reference.

If you are sharing, the tenancy cannot be approved until each and every sharer has successfully applied. Legally, you will each be liable for the whole of the rent and not just “your own share” however the credit reference company will assess your individual ability to pay the rent on a part share basis.

Assuming your application is successful the agent will set a date for when the tenancy agreement will be sent out digitally. All of the tenants will need to attend the appointment or will need to sign the tenancy agreement in advance. Any Guarantor(s) will also need to sign in advance.

You will be asked to ensure you have “cleared funds” meaning cash or a banker’s draft (the bank will charge you a small fee to provide this) or possibly a debit card payment. You will not be able to pay by cheque or credit card. We use a payment system called PayProp, you will need to make the full payment into this and if you have opted for the deposit replacement scheme you will receive the bank details for this payment.

The tenancy is not legally binding until it has been signed. If the property has been advertised through several agents simultaneously it is important that the agent you are using communicates with the landlord to ensure that only your application is proceeding. If the landlord changes his mind or lets through another agent then unfortunately there is very little your agent you can do to. However, you should be refunded your application fees and the agent should make every effort to find you suitable alternative accommodation.

Guarantor

Agents normally use credit referencing companies to carry out checks and provide a recommendation on your suitability. If you have no adverse credit history but are financially weak for the rental amount then you may be able to arrange a Guarantor.

A Guarantor is someone who agrees to abide by all of the terms of tenancy agreement, including the payment of rent, but has no right to live at the property. Your Guarantor will also need to be credit checked and there is normally an extra fee to pay for this.

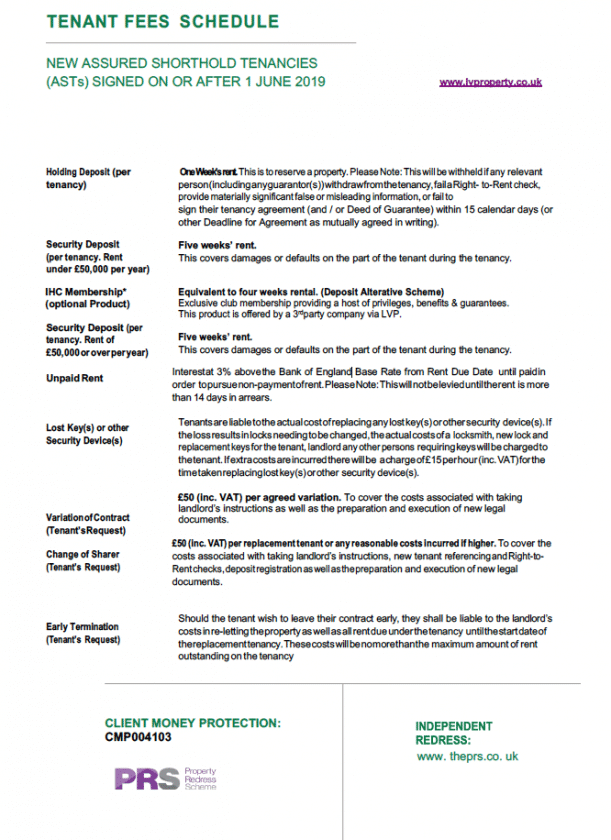

When you agree to rent a property you will be not be expected to pay any fees to LV PROPERTY from the 1st June 2019.

Before you reserve the property of your choice you will be offered either a DPS Deposit Protection Scheme or Deposit Alternative Scheme the alternative scheme will offer more flexibility and cost savings over time.

Find out who is managing your property and make sure you have been given all their contact details. That way, if something goes wrong on the property, you’ll know who to get in touch with.

Look after the property as if it were your own. This reduces the likelihood of disputes over damage when the tenancy comes to an end.

Remember that you should arrange insurance cover for your furnishings and personal property – the landlord is not responsible for insuring these items.

You will be provided with a ‘Schedule of Condition and Inventory’ relating to your property. Tenants need to read this document thoroughly and notify the agent of any discrepancies as quickly as possible after the start of your tenancy. Most agents will set a time limit of around seven days, after which it’s assumed you are accepting the property in the condition described. The agent or Inventory provider may wish to revisit the property to verify the discrepancies.