The tax relief that landlords of residential properties get for finance costs will be restricted to the basic rate of Income Tax, this will be phased in from April 2017.

LV Blogs & Latest News

The Multi-Award Winning Estate Agent

The Multi-Award Winning Estate Agent

The tax relief that landlords of residential properties get for finance costs will be restricted to the basic rate of Income Tax, this will be phased in from April 2017.

The amount of Income Tax relief landlords can get on residential property finance costs will be restricted to the basic rate of tax.

The changes will:

Finance costs won’t be taken into account to work out taxable property profits. Instead, once the Income Tax on property profits and any other income sources has been assessed, your Income Tax liability will be reduced by a basic rate ‘tax reduction’. For most landlords, this’ll be the basic rate value of the finance costs.

You’ll be affected if you’re a:

All residential landlords with finance costs will be affected, but only some will pay more tax.

You won’t be affected by the introduction of the finance cost restriction if you’re a:

You’ll continue to receive relief for interest and other finance costs in the usual way.

The finance costs that will be restricted include interest on:

Other costs affected are:

If you take a loan for both residential and commercial properties, you’ll need to use a reasonable apportionment of the interest to work out your finance costs for the residential properties. Only the finance costs for the residential property business are restricted. This also applies if your loan was partly for a self-employed trade and partly for residential property.

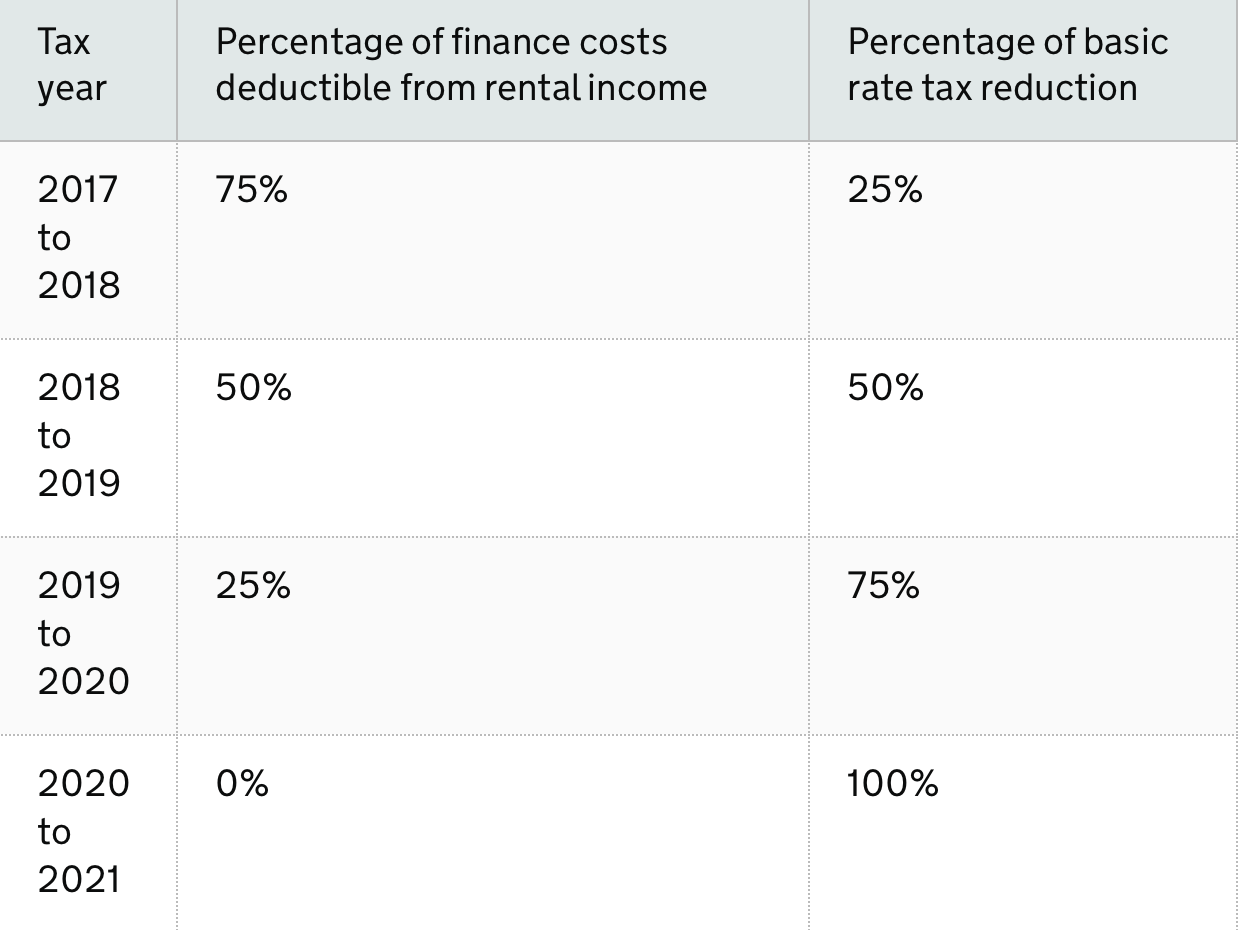

The restriction will be phased in gradually from 6 April 2017 and will be fully in place from 6 April 2020.

You’ll still be able to deduct some of your finance costs when you work out your taxable property profits during the transitional period. These deductions will be gradually withdrawn and replaced with a basic rate relief tax reduction.

You’ll be able to use some of your finance costs to work out your property profits and use your remaining finance costs to work out your basic rate tax deduction:

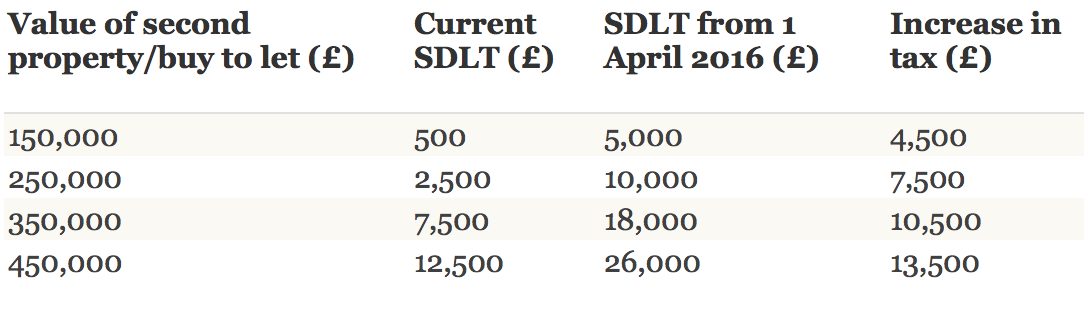

Buy-to-let investors are paying thousands of pounds extra in tax when they buy a property following the announcement of special “landlord” stamp duty tax rates which were applied last in 2016.

Stamp duty rates are three percentage points higher for buy-to-letters than those buying a property to live in.

It means the tax bill on a buy-to-ley property costing £250,000 will jump from £2,500 to £8,800. More examples are in the table below.

The same increased stamp duty rate applies to buying other second properties, such as holiday homes, in which the owners do not intend to live full-time.

Even with the new tax changes we have seen a surge in buy to let investors snapping up property in Birmingham city centre.

We believe landlords / investors are buying in Birmingham simply because they feel there will be capital growth in the coming years.

Our investment specialists in Birmingham city centre are dealing with buyers from all over the world on a day to day basis so if you’re thinking about investing in Birmingham please do feel free to call us on 0121 285 7575 to have a general chat about how we can help you make the right choice.