A 17% increase since pre-stamp duty surcharge which was introduced on second homes 3 years ago

- Nearly three in five (59%) London-based landlords purchased their buy-to-let properties outside the capital during the last 12 months, up from one in four (25%) in 2010.

- 34% of London-based investors bought buy-to-lets in the Midlands and North during the last 12 months, up from just 14% in 2015 and 4% in 2010.

- A landlord buying in London during the last 12 months faced a £24,600 stamp duty bill on average, compared to £5,330 for an investor buying outside the capital.

- Rents in Great Britain increased 1.9% year-on-year in March, driven by a 3.7% rise in Greater London where rents hit a record high.

Nearly three in five (59%) London-based (i.e. living in London) landlords purchased their buy-to-let property outside the capital during the last 12 months (Chart 1). Historically, London landlords bought their investment properties near where they lived. In 2010 just one in four (25%) London-based landlords purchased their buy-to-let outside the capital, with 75% investing in London.

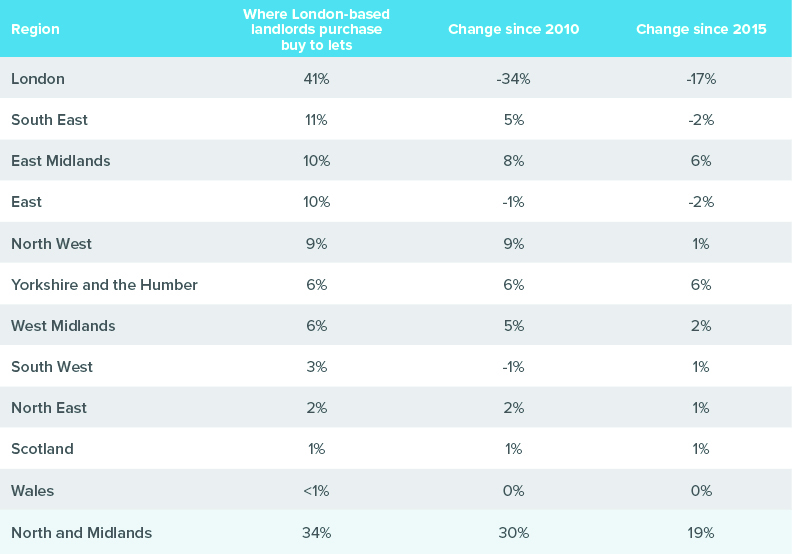

However, due to high house price growth and a clampdown on landlord taxation, more London-based landlords have chosen to invest further afield in search of higher yields and lower stamp duty bills. The proportion of London-based investors purchasing buy-to-lets in their home region has fallen 17% since 2015 (before the stamp duty surcharge on second home purchases was introduced in April 2016) (Table 1).

A landlord buying in London during the last 12 months faced a £24,600 stamp duty bill on average, compared to £5,330 for an investor buying outside the capital. The average stamp duty bill for an investor buying in London is now £11,760 more compared to pre-stamp duty changes (Q1 2016), but only £3,910 higher for an investor purchasing outside London.

As a result, a record proportion of London investors have headed North to purchase buy-to-lets. 34% of London-based investors bought buy-to-lets in the Midlands and North during the last 12 months, up from just 14% in 2015 and 4% in 2010 (Table 1). The East Midlands and Yorkshire & Humber saw the greatest increase following the stamp duty surcharge introduction, with 6% more London landlords buying investment properties in those regions than in 2015 (Table 1).

The South East remains the most popular destination for London-based landlords purchasing buy-to-lets outside the capital. 11% of London-based landlords purchased their buy-to-lets in the South East over the last 12 months, 2% fewer than in 2015 (Table 1). Dartford is the most popular destination for London-based landlords in the South East. Landlords living in London bought 60% of buy-to-lets in Dartford during the last 12 months (Table 2).

Rental Growth

The average cost of a new let in Great Britain rose to £969 pcm in March as rental growth continues to rise. Rents in Great Britain increased 1.9% year-on-year, driven by a 3.7% rise in Greater London. The average rent of a home in Greater London rose to £1,737 pcm, the highest level on record. Meanwhile, Scotland was the only region where rents fell in March, down -0.1% year-on-year (Table 3).

Commenting Aneisha Beveridge, Head of Research at Hamptons International, said:

“April marks the three year anniversary of the stamp duty surcharge introduction for second homeowners. Following the tax hike, landlords have been adapting their strategy to find new ways to make their returns. Lower entry costs and higher yields outside of the capital are enticing investors to look further afield than they have previously.

“Following a sluggish 2018 London rents reached a record high in March. The average cost of a new let in London rose to £1,737 pcm in March, 2.3 times more than the average rent outside the capital. Meanwhile every region in Great Britain recorded rising rents last month other than Scotland.”

Source: Hamptons International